Oncology Care Model – Assessing Portfolio Risk

CMS created the Center for Medicare and Medicaid Innovation (Innovation Center) in 2010 as part of the Patient Protection and Affordable Care Act. Their purpose is to test innovative payment and delivery systems with the goal of improving quality of care.

One of the Innovation Center’s episode-based payment initiatives is the Oncology Care Model (OCM). In contrast to the prevailing fee-for-service model, episode-based payment models hold health care providers accountable for the cost and quality of care that beneficiaries receive. With more than 1.6 million people diagnosed with cancer in the US each year, ~50% of whom CMS estimates are Medicare beneficiaries, improvements in episodes of oncology care could be quite impactful.

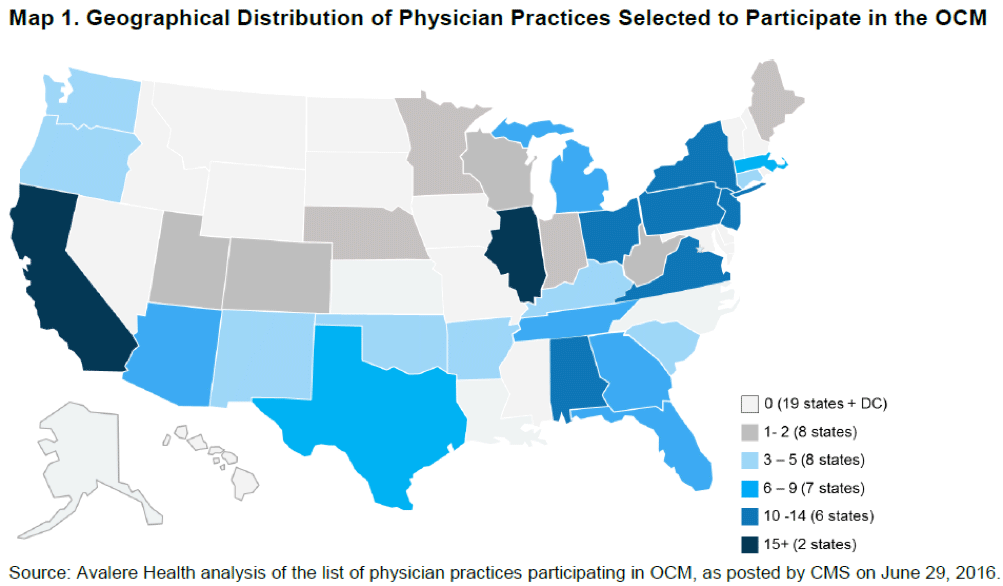

On July 1, nearly 200 oncology practices and 17 payers across 31 states began participating in the OCM. In general, this model looks similar to a patient-centered medical home (PCMH) with a target expenditure and shared savings to manage the total cost of patient care. The OCM model targets chemotherapy and related care during a 6-month period following the initiation of chemotherapy treatment. The goal is to utilize appropriately aligned financial incentives for improving:

- Care coordination

- Appropriateness of care

- Access for beneficiaries undergoing chemotherapy

Medicare beneficiaries need to meet each of the criteria to be included for OCM-FFS:

- Eligible for Medicare Part A and enrolled in Medicare Part B

- Have Medicare FFS as their primary plan

- Do not have end-stage renal disease

- Are not covered by United Mine Workers

- Receive an included chemotherapy treatment for cancer under management of an OCM participating practice

There are specific requirements for inclusion in the OCM for both Medicare beneficiaries and for provider practices. Notably, the OCM lists out six specific practice requirements to drive transformation in quality of care delivered. These requirements focus primarily on infrastructure, use of data for tracking, and patient engagement. One of the six requirements for facilities participating in the OCM is to treat patients with therapies consistent with national registered clinical guidelines. While guidelines are commonly being used in Oncology, this will be the first broad effort to enforce alignment by requiring practices to justify deviations from selected guidelines.

Two additional key aspects of the OCM are the participation of commercial payers with their associated practices, and comprehensive solution offerings from infrastructure providers like Flatiron, McKesson and others.

Pharmaceutical manufacturers will not be playing a direct role in the OCM but they could feel its impact through reductions in drug usage as the focus shifts towards improving quality of care while managing cost per episode.

Pharma / Biotech manufacturers of oncology drugs can start by assessing the role of their drug and its timing in relation to chemotherapy. Oncology practices will be required to provide target savings of 4% compared to their average historical cost of comparable 6-month episode. As the episode kicks off with chemotherapy, any drugs used prior to chemotherapy should see minimal direct impact from the OCM. Drugs used in conjunction with chemotherapy or within six months of first chemotherapy, however may come under closer scrutiny if they make up a sizeable portion of the overall cost of a 6-month episode.

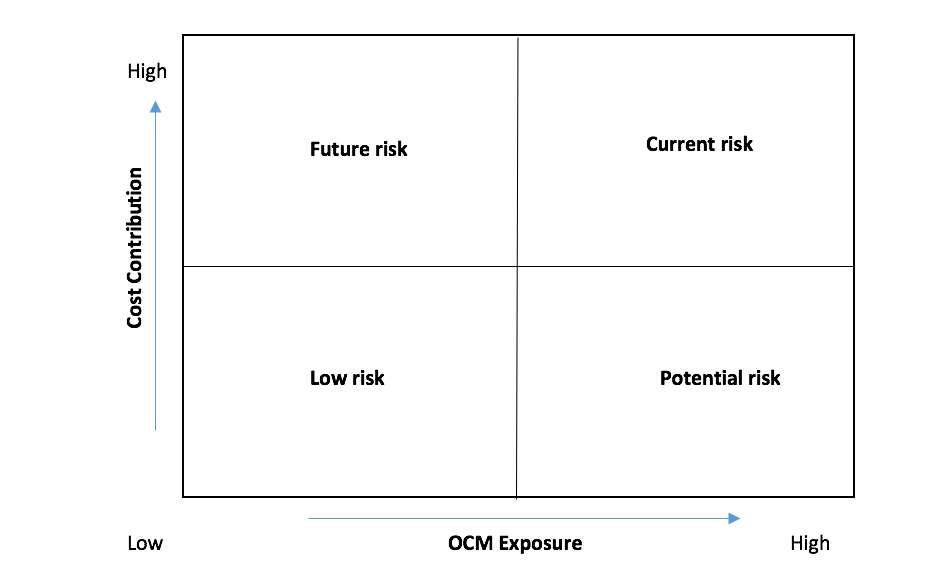

As OCM implementation progresses, there will be questions from sales management about its impact on the performance of their portfolio. Analytics teams can prepare in advance for these questions by leveraging data sources already at their disposal. We recommend a simple assessment framework based on 3 aspects of the overall oncology portfolio using the OCM lens to understand its impact and communicate potential implications within the organization:

- OCM Exposure: Rate each brand based on the usage of the product within 6 months from the first chemotherapy episode

- Cost Contribution: Rate brands based on their contribution to the total cost of the overall 6-month episode

- Product revenue: Rank products based on their revenue

The oncology portfolio can be mapped on the 2x2 grid to identify at risk products. Product revenue can then be used to prioritize focus within each quadrant.

In the next post, we will review the impact of OCM for key products at risk on incentive compensation, performance planning / reporting, and managed care contracting.

159 Solutions has significant experience in Oncology and working with claims data from various providers. We can help you conduct an assessment of your portfolio using the above framework, and come up with actionable insights to maximize utilization of your portfolio among facilities participating in the OCM.